Soludo heads 6-member committee to engage CBN on Naira redesign, cash withdrawal

Th Nigeria Governors’ Forum has resolved to set up a 6-member committee to engage the Central Bank of Nigeria, CBN on its recent policies on Naira redesign and cash withdrawal limits.

The governors’ decision was contained in a communique signed by Aminu Waziri Tambuwal Chairman, Nigeria Governors’ Forum and Governor, Sokoto State after a meeting Thursday.

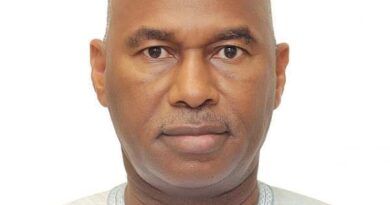

According to the communique, the governors resolved to “Finally set up a 6-member Committee to be Chaired by the Governor of Anambra State, Professor Charles Soludo and the Governors of the following States: Akwa Ibom, Ogun, Borno, Plateau and Jigawa as members, to engage the CBN in addressing anomalies in the country’s monetary management and financial system.

Other parts of the communique reads: “We, the members of the Nigeria Governors’ Forum (NGF), received a briefing from the Governor of the Central Bank of Nigeria, Mr Godwin Ifeanyi Emefiele, on the Naira redesign, its economic and security implications including the new withdrawal policy.

“Governors are not opposed to the objectives of the Naira redesign policy.

“However, we observe that there are huge challenges that remain problematic to the Nigerian populace. In the circumstances, Governors expressed the need for the CBN to consider the peculiarities of States especially as they pertain to financial inclusion and under-served locations and resolved to:

“Work closely with the CBN leadership to ameliorate areas that require policy variation particularly the poorest households, the vulnerable in society and several other citizens of our country that are excluded.

“Collaborate with the CBN and the Nigerian Financial Intelligence Unit (NFIU) in advancing genuine objectives within the confines of our laws, noting that the recent NFIU Advisory and Guidelines on cash transactions were simply outside the NFIU’s legal remit and mandate.